One of the key mantras which all 3E staff live by is that we listen to understand, not to respond. Our fundamental goal is to provide you with the best possible outcomes for your business.

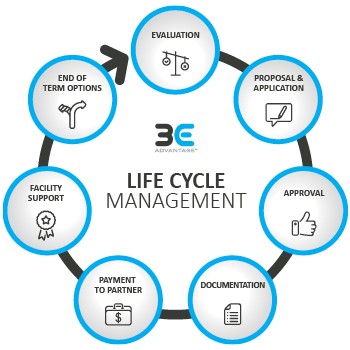

Whether purchasing a single asset or piece of equipment or developing a long term partnership with a new provider, our team will evaluate your specific requirements to ensure that we can provide you with tailored asset and equipment finance payment solutions.

We ask that you help us to understand what your business objectives are with your acquisitions, and discuss your previous experiences by examining areas that worked well and those that need improvement.

We provide you with a range of options backed with detailed information to enable you to make the most appropriate decisions.

Ensuring that you combine the right solution for today with the flexibility for tomorrow is crucial. 3E believes in getting the groundwork right from the start to enable a simple and ongoing engagement to suit all requirements.

Our extensive relationships with multiple local and global funding sources ensure that we provide you with the best possible financial solution. The 3E Advantage also means that you can manage all of your asset financing requirements from one source, cutting down your administrative burden and costs and maximising efficiency for your business and processes.

In business, there is nothing more constant than change. 3E’s philosophy is to continually challenge the norm for the benefit of our clients. We will work with you throughout the entire asset finance life cycle to ensure our solutions and approach evolve in step with your business needs.

Our expert team provide tailored asset finance payment solutions to suit your businesses needs.

As well as offering all ‘vanilla’ asset and equipment finance payment solutions such as;

• Rental

• Finance Lease

• Chattel Mortgage,

which are standard in the market, 3E stands apart from the competition by providing the following additional value adding asset and finance payment solutions to our clients.

You gain the benefit of income generating assets without the risks associated with ownership, with the added advantage of included maintenance on one bill.

Avoid that up-front capital investment shock and pay for your software solution over an extended term.

Let your new asset pay for itself while it is delivering value through fixed payments over a term, without the up-front capital expenditure.

A volume based solution for your print equipment needs, with flexible billing options that can be aligned to your business model.

An all-inclusive volume based solution, providing you with peace of mind on your monthly spend.

Reduce the complexity of managing a larger frequently revolving fleet of devices in multiple locations and cost centres with varied requirements.

Contact one of our finance specialists now to discover how the 3E Advantage can work for your business